Carbon quotas

Carbon quota is the quota of carbon emission right, which is the most important carbon trading product in China, and is mainly used in thermal power related enterprises. It is expected that by 2025, all key emitting industries such as electric power, petrochemical, chemical, building materials, steel, nonferrous metals, paper making, electric power and aviation will enter the carbon cap-and-trade system.

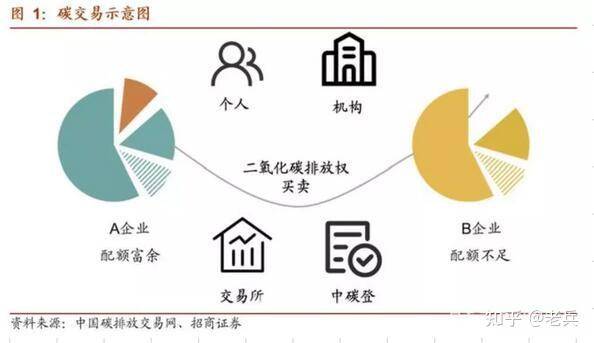

Carbon quotas by the national ecological environment according to the provincial environment agency reported major emissions unit of area, according to the total emission control and milestones, after the approval of the State Council, shall be formulated by the governments at all levels in a industry the amount of greenhouse gas emissions caps, then authorization or sold to firms have limits of the prescribed discharge permit. If companies emit more than the limit of their permits within a specified period, they must buy permits in the carbon market; If companies emit less than the cap, they can sell the surplus quota on the market.

Open baidu APP to see hd pictures

In addition, the Measures for the Administration of Carbon Emission Trading (Trial) stipulates that the trading subjects of the national carbon emission trading market are "institutions and individuals", and there is no carbon quota trading between administrative divisions. By setting the carbon emission price, the carbon quota trading market encourages enterprises to enhance the intrinsic motivation of low-carbon emission reduction with the benefit regulation mechanism, and meanwhile promotes investors to invest in clean and low-carbon industries, so as to achieve the goal of controlling the total carbon emission.

China Carbon Emission Trade Exchange (CCETE) is the venue for Carbon quota trading. Since the pilot work of carbon emission right trading was carried out in Beijing, Tianjin, Shanghai and other places in 2011, CCETE was officially launched on July 16, 2021. The trading center is located in Shanghai and the registration center is located in Wuhan, adopting three trading methods: listing agreement transfer, bulk agreement transfer and one-way bidding.

It should be noted that since carbon quota is the main trading product in carbon trading, there are many expressions that simply equate "carbon emission right trading market" with "carbon trading market", which is not rigorous.

The state certifies voluntary emission reduction

China Certified Emission Reduction£¬CCER

CCER refers to the greenhouse gas emission reduction effect of specific projects in China that is quantified and verified and registered in the National Greenhouse Gas Voluntary Emission reduction Transaction Registration system.

Companies voluntarily reduce or clean up greenhouse gases by adopting new energy sources (hydropower, photovoltaic, wind power) and forestry carbon sequestration. Such voluntary emission reduction needs to be reported and approved by the National Development and Reform Commission in advance, and can be called CCER after verification by relevant departments. It can be used to offset part of carbon emissions in the implementation of emission control enterprises, which can not only properly reduce the implementation cost of enterprises, but also bring some benefits to emission reduction projects and promote the development of enterprises from high carbon emissions to low carbon.

CCER constructs a channel to offset the carbon emissions of key emission units with emission reduction credits generated by projects with obvious emission reduction effects and outstanding ecological and environmental benefits. If the core logic of carbon quota trading is "transfer", then the core of CCER is "offset".

However, since THE CCER project was allowed to participate in carbon trading in 2012, from March 2017, the NDRC suspended the CCER project due to the small amount of voluntary greenhouse gas emission reduction trading volume and the lack of standardization of individual projects. Until December 2020, the Interim Measures on the Management of Carbon Emission Right Trading (Trial) explicitly included CCER back into the carbon trading market. In March 2021, the Ministry of Ecology and Environment issued the Interim Regulations on the Management of Carbon Emission Trading (Revised Draft), which pointed out that renewable energy, forestry carbon sequestration and methane utilization projects could restart CCER certification.

Of the three, renewable energy -- projects powered or heated by wind, solar, hydro, biomass, geothermal and Marine -- accounts for about 70 percent of CCER's total development.

Forestry carbon sink is a CCER project developed according to the function of plant carbon sink. Carbon Sink refers to the mechanism by which Carbon dioxide in the atmosphere is absorbed through afforestation, vegetation restoration and other measures, so as to reduce the concentration of greenhouse gases in the atmosphere. Thus, forest Carbon Sink, forestry Carbon Sink, grassland Carbon Sink, ocean Carbon Sink and other forms are derived.

It is worth noting that in CCER projects from 2012 to 2017, carbon sequestration projects only accounted for 3% of all projects, which is closely related to the complex technology and long development cycle of carbon sequestration projects. There are five existing CCER methodologies related to forestry, among which ar-CM-001 carbon sequestration afforestation project methodology is the most used, accounting for more than 60% of the total use times.

However, the Opinions on Establishing and Improving the Value Realization Mechanism of Ecological Products issued by the General Office of the CPC Central Committee and The General Office of the State Council in April 2021 proposed to "improve the carbon emission right trading mechanism and explore the pilot carbon sink equity trading", stating the concepts of the two levels of carbon emission right trading and carbon sink equity trading are not equal. In the author's opinion, this is because forestry carbon sink, combined with the concept of "clear water and green mountains are gold and silver mountains", has become a breakthrough for rural revitalization and value transformation of ecological products, and is likely to become a new hot spot after CCER restarts.

For example, on July 30, 2021, Zhejiang Anji Rural Commercial Bank calculated the emission reduction of a total of 1030 mu of Bamboo forest contracted by Yang Zhongyong in Tongli Village, Baofu Town according to "Bamboo Forest Management Carbon Sink Project Methodology". It is estimated that the carbon emission can be reduced by 7045 tons during the contract period. Based on the carbon emission trading price in the national carbon emission trading market on July 16, 2021, The conclusion was drawn that the carbon sink value of forestland was 371,900 yuan, and the pledge registration and publicity were carried out through the unified registration and publicity system of movable property financing of the Credit Investigation Center of the People's Bank of China. The first bamboo carbon sink pledge loan of 370,000 yuan was successfully launched in China, which promoted the bamboo ecological value monetary and the formation of bamboo carbon sink industry.

Financial instruments

At present, China's carbon trading financial instruments are still in their infancy, but in the case of increasingly perfect carbon spot commodity trading, the development of market-based financial instruments will play a greater role. Vigorously developing emission pledge, carbon futures, carbon options and structured financial products linked to emission rights will be one of the key construction works to promote the national carbon trading market, and can promote the diversification and stability of the carbon trading market.

For example, In March 2021, Fuzhou Sanming Co., Ltd. issued Sanming Forestry Carbon Ticket Management Measures (Trial), innovatively exploring functional "carbon tickets". Carbon stamp is the certificate of the right to profit from carbon emission reduction of forest trees, equivalent to the "ID card" that the carbon sequestration and oxygen release function of forest can be traded as assets, which is the same as the underlying mechanism of forestry carbon sink. However, one of the innovations of Sanming carbon ticket is that it has the function of pledge and circulation. Enterprises that purchase carbon tickets can mortgage their carbon tickets to further invigorate their carbon assets. The second innovation is to broaden the adaptability of carbon sink. According to the existing methodology of forest carbon sink project, ecological public welfare forest, natural forest, and commodity forest in key locations cannot be developed for forest carbon sink project, but in Sanming, as long as the forest land and forest with clear ownership can apply for carbon credits. Therefore, Sanming carbon ticket further enhances the vitality of forestry carbon sink market by endowing forestry carbon sink with certain financial functions.

To sum up, the carbon quota, CCER and financial instruments of China's carbon trading market system are booming. However, it should be noted that compared with the mature carbon trading market in the EU, China's carbon trading market is still in the initial stage of development due to its lack of financial degree and market participation, small scale and trading varieties, and incomplete policy supporting system. It is also necessary to provide policy support and market guarantee through reasonable design of carbon trading market management mode, vigorously cultivate both supply and demand sides of carbon trading market, improve relevant laws and regulations and policy matching, strengthen international cooperation of carbon trading market, and so on, so as to continuously develop and gradually mature.

NEXT£ºIs already the first£¡

BACKMedia interview on carbon cleaning technology

2022-03-23European Commission approves Carbon Boundary Regulation Mechanism (CBAM)

2022-03-18[News] Carbon technology was invited to attend the carbon Peak carbon neutralization work symposium

2022-03-04[Review of the first year of the National Carbon Trading Market]

2022-03-18"Clean Carbon Technology" was invited to conduct professional training on double carbon for the League of Nations Group

2021-12-23COP26 -- The best time and the last chance!

2021-11-12When we talk about carbon neutrality, what are we talking about?

2021-10-28Support for the

2021-10-19Enabling a zero-carbon future

2021-10-15Carbon removal technology helped wuxi Bureau of Ecology and Environment "tin carbon walk" activities

2022-02-26

ËÕ¹«Íø°²±¸31010702002557ºÅ

ËÕ¹«Íø°²±¸31010702002557ºÅ